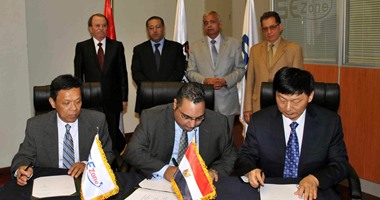

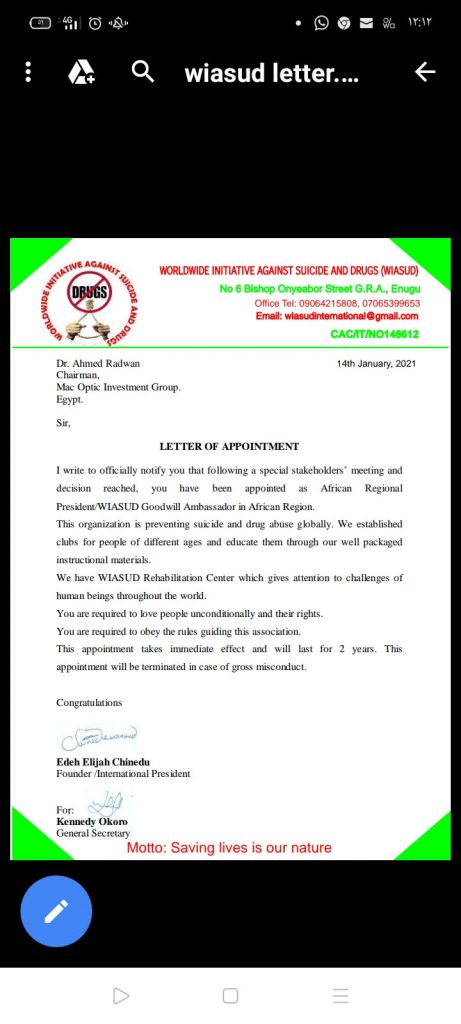

The Greek Mac Optic Group has initiated procedures with the Financial Regulatory Authority to establish three new companies focused on small and medium enterprise financing, securities trading, and real estate financing, with a paid-up capital of 350 million pounds, according to statements from Dr. Ahmed Radwan, CEO of Mac Optic Group, to Al-Mal.

The activity is set to begin before the end of the current year under the umbrella of “Mac Holding.”

Radwan stated that the three new companies will operate under “Mac Holding,” which is expected to finalize its establishment procedures before the end of this year.

Al-Mal previously reported on the plans of Mac Optic to establish a holding company in Egypt named “Mac Holding,” which will encompass several subsidiaries working in four new investment sectors: banking investment, media, education, and healthcare, with a capital of $100 million.

Radwan revealed that Mac Optic is intensifying its efforts to complete the establishment of the three companies next month, aiming to start actual operations for one or two of them before the year ends.

He added that it is possible to consider listing these companies on the stock market at later stages.

It’s worth noting that Mac Optic is a private Greek company founded in 1995, operating in several countries, including Cyprus, Bulgaria, Canada, and Iraq. Its main areas of work include cement production, supply of food products, medical supplies, refining, and other economic activities, with a focus on investing in the local market.

Radwan mentioned that these sectors are being entered by the company in Egypt for the first time, although they have successful experience in small and medium enterprise financing in Canada.

He continued: “The Egyptian market is promising, and we decided to inject new investments despite the challenges posed by COVID-19 globally, especially with the anticipated rise in demand in the local market, which presents an opportunity for investment expansion, particularly in small and medium enterprise financing.”

He indicated that the company has prepared comprehensive feasibility studies to enter these activities in the Egyptian market, expecting good returns from them. He emphasized that the current period shows significant facilitation in procedures and the removal of obstacles for investors.